The new operating system of healthcare

Healthcare is quietly switching its “operating system”. For most of the last century, care was organized around buildings, scheduled appointments, and local clinical capacity. Patients traveled to the system, and the system tried—often imperfectly—to meet them there. That architecture produced incredible advances, but it also created friction: long wait times, uneven access, rising costs, and overloaded staff.

Telemedicine and medical AI are changing that architecture at the same time, and that is why they are often discussed together. Telemedicine solves the “where” problem: it moves parts of care to the patient’s location—home, work, or anywhere with connectivity. AI increasingly solves the “how” problem: it helps clinicians and organizations make decisions faster, reduce administrative burden, detect risk earlier, and scale expertise. Together, they create the possibility of care that is more continuous, more personalized, and more available—while still being evidence-based and safe.

This article looks at both categories in a structured way:

- What telemedicine platforms actually are in 2025–2026 (beyond “video calls”).

- What “AI in medicine” means in practice (beyond hype), including generative AI and clinical copilots.

- How the market is evolving globally, including published growth projections and modeled intermediate-year trends.

- A pragmatic forecast for 2026 and the next few years: what is likely to become standard, what will remain experimental, and what risks need stronger governance.

Definitions (to keep everything clear)

Telemedicine typically refers to remote clinical services (diagnosis, treatment, follow-ups) delivered via digital communication, often video, phone, chat, and remote monitoring.

Telehealth is a broader umbrella that may include non-clinical services like health education, administrative tools, or wellness coaching.

AI in medicine spans many tools:

- Predictive models (risk scores, early warning systems).

- Computer vision (imaging, pathology, dermatology).

- Natural language processing (summarizing notes, coding support).

- Generative AI (drafting clinical documentation, patient messaging, care plans—with guardrails).

A simple operational translation:

- Telemedicine reorganizes access and care pathways.

- AI reorganizes work and decision support inside those pathways.

Why both categories are scaling now

Several long-running forces have aligned:

- Consumer expectations moved toward on-demand services in every industry.

- Payment models and reimbursement pathways evolved unevenly but steadily.

- Hospital staffing constraints (especially in primary care, mental health, radiology, and nursing) became structural rather than temporary.

- Data availability expanded through EHR adoption and connected devices.

- AI capabilities leapt forward, especially in language and multimodal models.

The result is not a single “telemedicine future” or an “AI future,” but an integrated digital care stack.

Telemedicine platforms in 2025–2026

Telemedicine has matured from a “virtual visit” feature into full platforms that can run parts of a health system: scheduling, intake, identity verification, clinical documentation, prescriptions, referrals, payments, and follow-up. The most successful services are not just good at video—they are good at workflow.

What modern telemedicine platforms actually do

A robust telemedicine platform typically supports:

Access layer

- Mobile and web experiences.

- Asynchronous chat (store-and-forward) and synchronous video.

- Multilingual and accessibility features.

Clinical workflow

- Structured intake and triage.

- Clinical documentation templates.

- E-prescribing, lab orders, and referral routing.

- Care pathways for common conditions.

Operations

- Provider scheduling and availability routing.

- Billing support and claims workflows (where applicable).

- Quality assurance and clinical governance tools.

Integration

- EHR interoperability (HL7/FHIR where possible).

- Device and remote patient monitoring (RPM) integration.

- Data export, analytics, and security controls.

In short: telemedicine platforms increasingly behave like mini-EHRs or front doors to EHRs—optimized for remote-first flow.

Key telemedicine models (and who they serve)

Telemedicine offerings usually fall into a few business models:

- Direct-to-consumer (DTC) urgent care: best for simple, acute issues and convenience; risk: fragmentation if it never connects to a patient’s longitudinal record.

- Virtual-first primary care: best for continuity, prevention, and chronic condition management; requires stronger integration and long-term clinical protocols.

- Enterprise telehealth for health systems: hospitals and clinics adopt platforms to extend capacity; strong focus on compliance, integration, and workflows.

- Specialty telemedicine: mental health, dermatology, women’s health, chronic disease, etc.; often combines remote visits with specialty-specific programs and education.

Where telemedicine is heading next (practical trends)

The next stage of telemedicine is not “more video”. It is:

- Hybrid care as the default: remote-first path with in-person escalation rules.

- Remote patient monitoring becomes mainstream: the key is care-team workflow and escalation thresholds, not just the wearable.

- AI-assisted triage and routing: reduce avoidable appointments and match urgency appropriately.

- More governance and standardization: SOPs, templates, auditability, and consistent QA.

AI in medicine: what is real vs what is noise

AI in medicine is not one product; it is a family of capabilities that enter clinical work through different doors. Some arrive as imaging tools, others as risk models in EHRs, and increasingly, many arrive as language-driven assistants that operate across documentation, messaging, and workflow.

The important shift in 2025–2026 is that AI is moving from “point solutions” into end-to-end clinical operations. This is powerful—and risky—because the failure mode is no longer “a model mislabels an image”. The failure mode becomes “a workflow silently changes,” which can affect thousands of patients.

The major categories of medical AI (simple map)

Diagnostic support (vision and signal processing)

- Radiology: prioritization, detection, quantification.

- Pathology: pattern recognition, biomarker discovery.

- Cardiology: ECG classification, risk prediction.

- Dermatology: lesion analysis.

Predictive and operational AI

- Readmission risk, deterioration risk, no-show prediction.

- Capacity planning, staffing optimization.

- Supply chain and bed management support.

Clinical NLP and documentation AI

- Summarization of long records.

- Drafting visit notes, after-visit instructions, referral letters.

- Coding suggestions and documentation completeness checks.

Patient-facing AI

- Symptom checkers (with careful scoping).

- Navigation assistants (where to go, what to do next).

- Medication reminders and coaching (with guardrails).

Why generative AI needs stronger control

Generative AI is compelling because it produces fluent language quickly. In healthcare, language is everywhere: notes, orders, messages, discharge instructions, authorizations, and policies. That creates enormous potential productivity gains.

It also creates new risks:

- Hallucinations (confidently wrong content).

- Over-trust (automation bias).

- Data leakage (PHI in uncontrolled systems).

- Inconsistent behavior across patient groups (bias and fairness issues).

- Undocumented workflow changes (“shadow AI” adoption).

A safer default posture for 2026 is: draft, don’t decide, embedded into validated workflows with human review, audit logs, and monitoring.

How AI and telemedicine reinforce each other

Telemedicine generates structured data and repeated touchpoints. AI benefits from both:

- Telemedicine platforms collect standardized intake and symptom data, which can improve triage models.

- Remote monitoring streams continuous signals that predictive models can use for early warning.

- High-volume virtual care makes documentation assistance more valuable because time becomes the bottleneck.

- Patient messaging at scale becomes feasible only with automation; AI can draft, but policy must define what is safe to automate.

Market figures and what they really mean

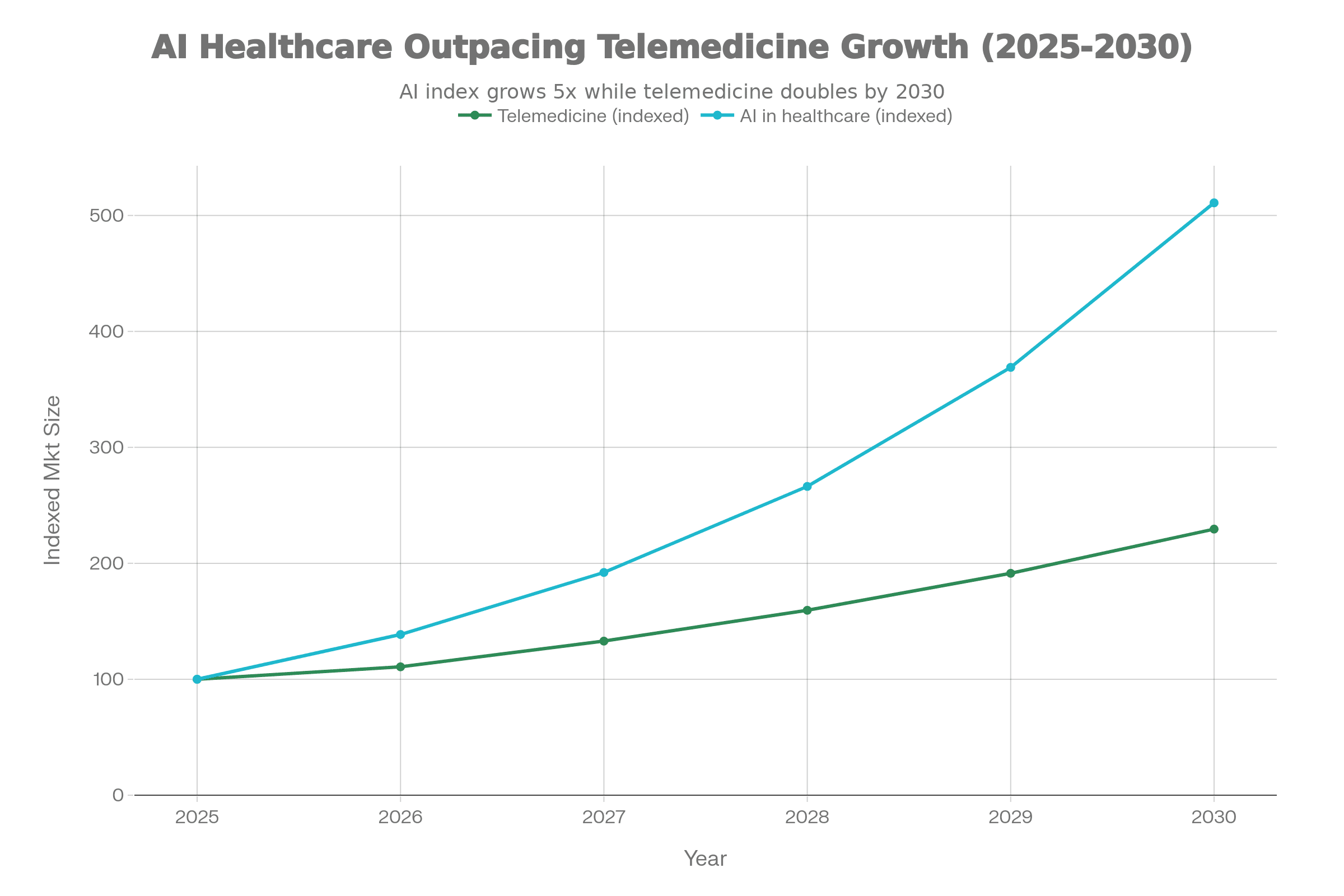

These numbers matter less as “market bragging rights” and more as signals that health systems, payers, and investors treat virtual care and clinical AI as long-term infrastructure.

Published market figures (telemedicine)

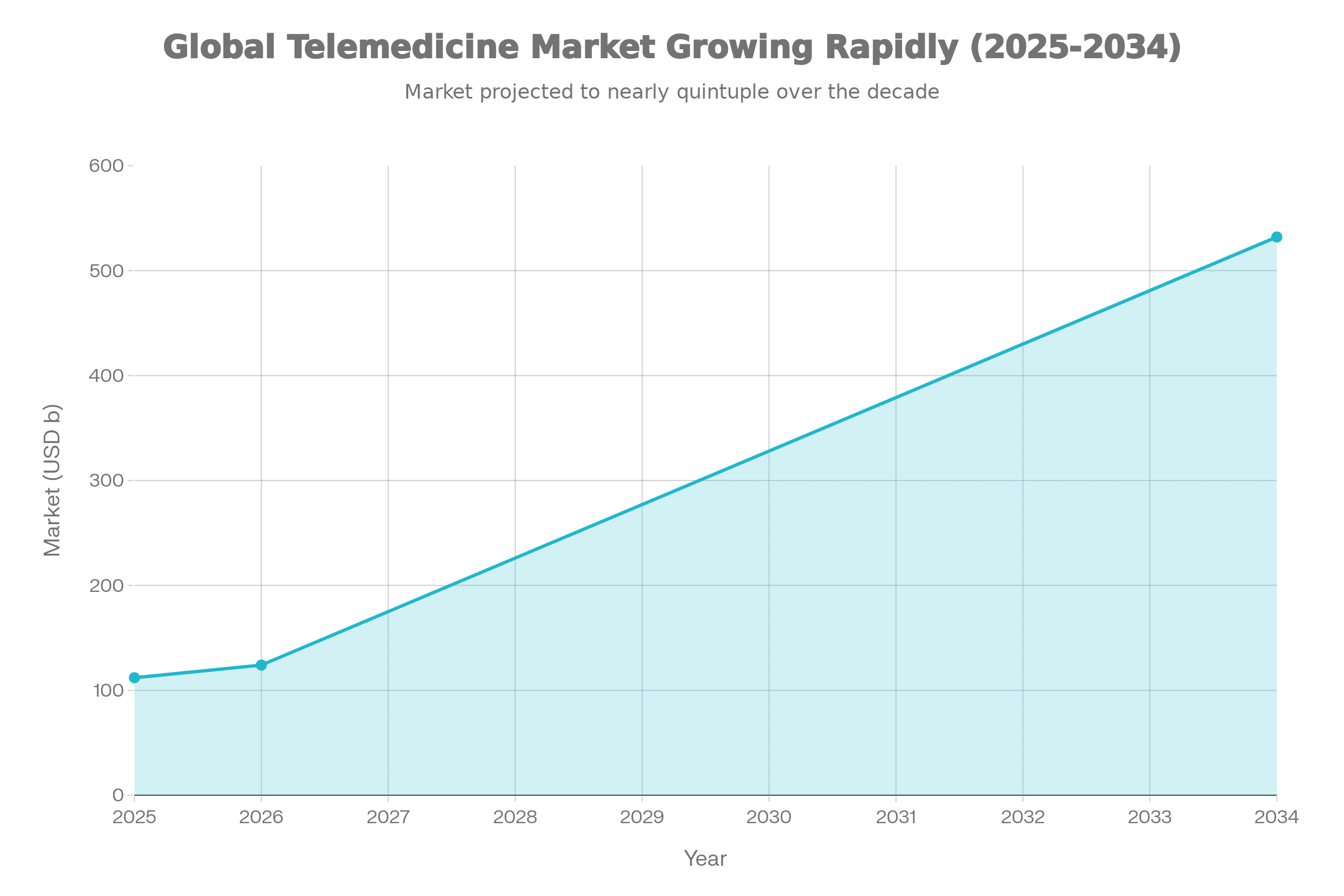

Fortune Business Insights reports the global telemedicine market size at USD 111.99B in 2025 and projects USD 124.01B in 2026, reaching USD 532.08B by 2034. The same source states a projected CAGR of 20.00% during the forecast period.

Published market figures (AI in healthcare)

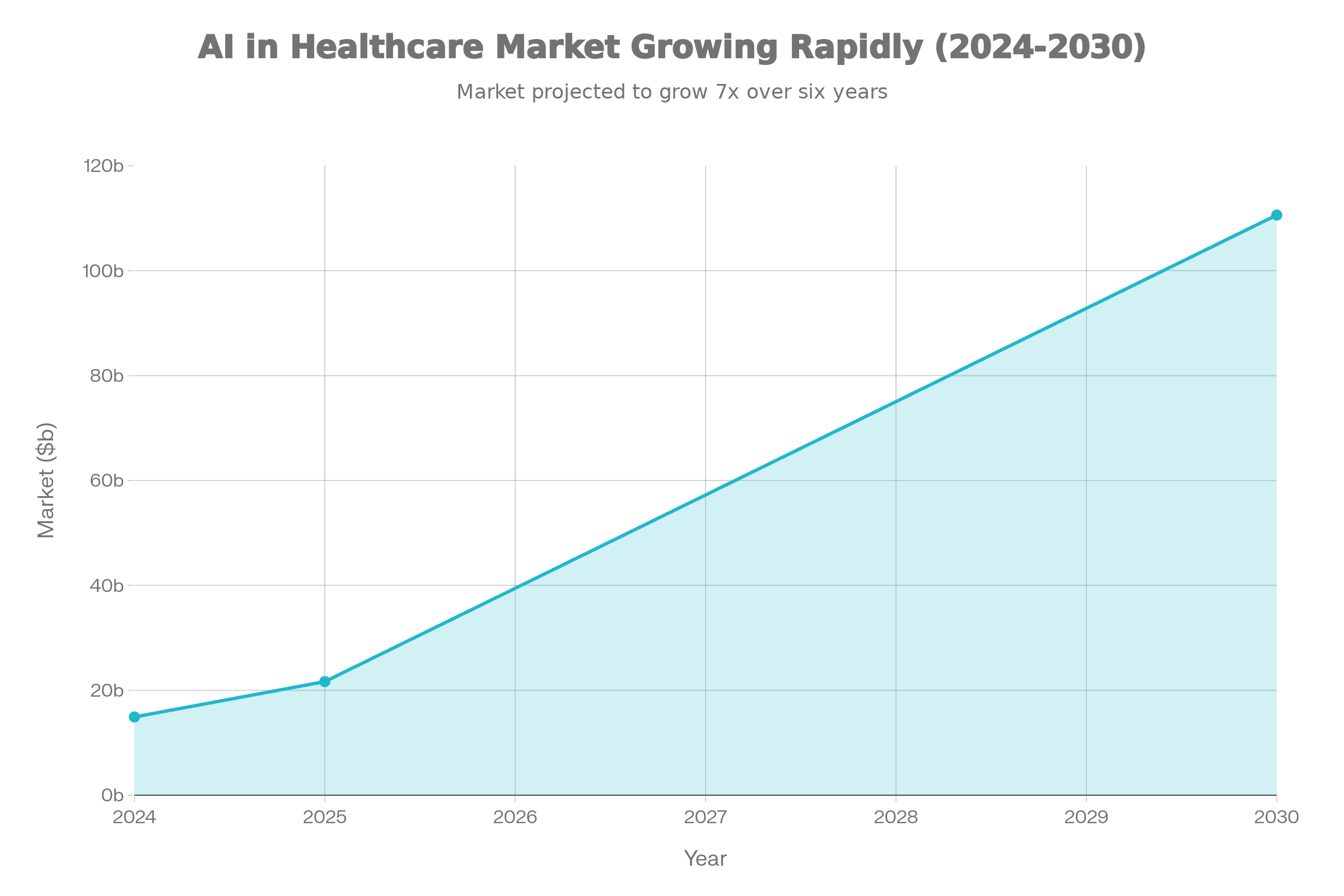

A MarketsandMarkets/PRNewswire release states the global AI in healthcare market was valued at USD 14.92B in 2024, is expected to reach USD 21.66B in 2025, and is projected to reach USD 110.61B by 2030 at a CAGR of 38.6%.

Market figures used in this article

| Category | Metric | Published figure |

|---|---|---|

| Telemedicine (global) | Market size 2025 | USD 111.99B |

| Telemedicine (global) | Market size 2026 | USD 124.01B |

| Telemedicine (global) | Market size 2034 (projected) | USD 532.08B |

| AI in healthcare (global) | Market size 2024 | USD 14.92B |

| AI in healthcare (global) | Market size 2025 | USD 21.66B |

| AI in healthcare (global) | Market size 2030 (projected) | USD 110.61B |

| AI in healthcare (global) | CAGR | 38.6% |

Telemedicine vs AI-in-medicine

The most mature organizations treat both as parts of one pipeline: access → triage → clinical decision → documentation → follow-up.

| Dimension | Telemedicine platforms | AI in medicine platforms/tools |

|---|---|---|

| Primary value | Access and continuity | Speed, scale, and decision support |

| Main “unit of work” | Visit, chat, monitoring episode | Prediction, classification, summarization, recommendation |

| Typical buyers | Health systems, payers, employers, clinics | Health systems, imaging groups, EHR ecosystems, payers |

| Biggest operational risk | Fragmentation of care, uneven quality | Unsafe automation, bias, weak governance |

| Winning capability | Workflow + integration | Validation + monitoring + auditability |

| KPI examples | Time-to-visit, resolution rate, follow-up adherence | Error rates, time saved, sensitivity/specificity, audit exceptions |

2026 outlook (practical forecast)

What 2026 likely looks like (telemedicine)

In 2026, telemedicine continues shifting from “pandemic-era alternative” to “designed-in channel,” especially for:

- Primary care follow-ups.

- Mental health and coaching programs.

- Chronic disease management.

- Post-discharge monitoring and medication management.

Expected 2026 pattern: health systems increasingly formalize hybrid care pathways (remote-first with in-person escalation rules). This is not only a tech decision; it is a clinical policy decision, and it requires training, protocols, and QA.

What 2026 likely looks like (AI in medicine)

Wolters Kluwer’s 2026 expert outlook describes deeper healthcare AI adoption driven by workflow integration, and emphasizes clinical-grade generative AI embedded as a trusted copilot with guardrails. SAS’s 2026 health and life sciences predictions point to accelerated adoption of AI-enabled clinical decision support to enhance diagnostic precision and personalization.

Most likely mainstream wins (2026)

- Ambient documentation and note drafting (with clinician sign-off).

- Inbox and patient message drafting (with strict policy limits).

- Summaries of long longitudinal records for faster chart review.

- Coding and authorization assistance (reducing back-office bottlenecks).

- Imaging workflow triage (prioritizing urgent cases).

Governance: “shadow AI” becomes a board-level issue

Wolters Kluwer explicitly flags “shadow AI” as a governance driver, pushing organizations to strengthen guardrails and use purpose-built GenAI systems trained on expert-validated evidence and transparent source citations.

Comparative tables: “what to buy” and “how to evaluate”

Telemedicine platform capability checklist (buyer view)

| Capability area | What “good” looks like in 2025–2026 | Why it matters |

|---|---|---|

| Intake & triage | Structured intake, red-flag logic, routing rules | Lower safety risk and less wasted capacity. |

| Scheduling & routing | Smart routing by availability, skill, language | Faster resolution and better matching. |

| Documentation | Templates, structured fields, quick sign-off | Better quality and less clinician burden. |

| Orders & eRx | Reliable prescribing + lab/referral ordering | Enables completion of care, not only advice. |

| Integration | EHR write-back/export, FHIR/HL7 where possible | Reduces fragmentation and repeat work. |

| QA & governance | Standard pathways + audit + peer review | Consistency scales better than “individual style”. |

| Security & identity | MFA, identity checks where needed | Reduces fraud and chart contamination. |

AI-in-medicine tool checklist (buyer view)

| Category | What “good” looks like | What to verify before rollout |

|---|---|---|

| Clinical validity | Proven performance in real populations | External validation + monitoring plan. |

| Workflow fit | Embedded in EHR/PACS/inbox | Avoids “pilot purgatory”. |

| Guardrails | Clear scope (“draft, don’t decide”) | Prevents unsafe autonomy creep. |

| Auditability | Logs, traceability, versioning | Enables governance and incident review. |

| Bias controls | Measured across subgroups | Supports fairness and safety. |

| PHI safety | Strong privacy/security posture | Reduces shadow AI pressure. |

Top 10 telemedicine websites (global visibility list)

This list focuses on widely visible web “front doors” repeatedly referenced in telemedicine company roundups (not a claim that they are #1 in every country).

| Platform | Official website | Evidence of “top list” visibility |

|---|---|---|

| Teladoc Health | https://www.teladochealth.com | Included in telemedicine company roundups. |

| Amwell | https://www.amwell.com | Included in telemedicine company roundups. |

| MDLIVE | https://www.mdlive.com | Included in telemedicine company roundups. |

| Doctor On Demand | https://www.doctorondemand.com | Included in telemedicine company roundups. |

| Babylon Health | https://www.babylonhealth.com | Included in telemedicine company roundups. |

| HealthTap | https://www.healthtap.com | Included in telemedicine company roundups. |

| Sesame | https://sesamecare.com | Included in telemedicine company roundups. |

| MeMD | https://www.memd.net | Included in telemedicine company roundups. |

| PlushCare | https://plushcare.com | Included in telemedicine company roundups. |

| Talkspace | https://www.talkspace.com | Included in telemedicine company roundups. |

Top 10 AI-in-medicine websites (AI Magazine Top 10)

AI Magazine’s “Top 10 AI Healthcare Companies” list includes Google, NVIDIA, Microsoft, AWS, Philips, Siemens Healthineers, GE HealthCare, Teladoc Health, Tempus, and Arterys.

| Organization | Official website | Included in AI Magazine Top 10 |

|---|---|---|

| Google (Health) | https://health.google | Yes. |

| NVIDIA | https://www.nvidia.com/en-us/industries/healthcare | Yes. |

| Microsoft | https://www.microsoft.com/industry/health | Yes. |

| Amazon Web Services (AWS) | https://aws.amazon.com/health | Yes. |

| Philips Healthcare | https://www.philips.com/healthcare | Yes. |

| Siemens Healthineers | https://www.siemens-healthineers.com | Yes. |

| GE HealthCare | https://www.gehealthcare.com | Yes. |

| Teladoc Health | https://www.teladochealth.com | Yes. |

| Tempus | https://www.tempus.com | Yes. |

| Arterys | https://www.arterys.com | Yes. |

Extra comparative table: where telemedicine and AI meet (use-case matrix)

This matrix helps teams decide “who owns what” and where integration work creates the biggest ROI.

| Care step | Telemedicine role | AI role | What “done well” looks like |

|---|---|---|---|

| Access / entry | Digital front door, scheduling, chat/video | Smart routing suggestions | Patient reaches the right level of care quickly. |

| Intake & triage | Structured questionnaires | Risk signals, red-flag detection | Less noise for clinicians; safer escalation rules. |

| Visit / consult | Remote exam workflow | Draft notes, summarize chart | Clinician time spent on decisions, not typing. |

| Diagnostics | Orders/referrals | Imaging triage / pattern detection | Faster prioritization; fewer missed urgencies. |

| Follow-up | Async check-ins, RPM programs | Early warning, adherence nudges | Prevent deterioration and avoid readmissions. |

| Admin & billing | Visit documentation | Coding and authorization support | Lower denial rates; faster throughput. |

Extra visuals & comparison layer

Telemedicine vs AI: what changes “in the org chart”

| Topic | Telemedicine (platform decision) | AI in medicine (capability decision) | Typical owner in 2026 |

|---|---|---|---|

| What changes | Where care starts and how it flows | How work is executed inside the flow | COO/CMO + digital health lead |

| Biggest upside | Access + continuity | Time savings + earlier risk detection | Clinical ops + informatics |

| Biggest risk | Fragmented care, uneven standards | Unsafe automation, bias, “shadow AI” | Compliance + risk + IT security |

| “Killer KPI” | Time-to-visit; resolution rate | Time saved; error/exception rate | Ops analytics team |

| Hardest part | Integration + clinician adoption | Governance + monitoring in production | AI governance committee |

Value chain map (where telemedicine and AI reinforce each other)

| Care stage | Telemedicine contribution | AI contribution | Failure mode to design against |

|---|---|---|---|

| Entry | Digital front door, remote access | Smart routing suggestions | Wrong routing → delays and risk |

| Intake | Structured history & symptoms | Risk flags, triage scoring | Over-triage or missed red flags |

| Consult | Video/chat workflows | Note drafting, chart summary | Hallucinated details in note |

| Diagnostics | Orders, referrals | Imaging prioritization | Silent workflow change in PACS/EHR |

| Follow-up | Async check-ins, RPM programs | Early warning, adherence nudges | Alert fatigue + missed escalation |

| Admin | Billing-ready documentation | Coding/prior-auth assistance | Automation bias, compliance errors |

Market graphs (kept + expanded context)

These three charts remain part of the article (no direct URLs shown), because they summarize the published market endpoints used in the forecast. Telemedicine endpoints are from Fortune Business Insights, and AI-in-healthcare endpoints/CAGR are from MarketsandMarkets/PRNewswire.

- Telemedicine market size chart (2025–2026 and projected

Telemedicine vs AI: what changes “in the org chart”

| Topic | Telemedicine (platform decision) | AI in medicine (capability decision) | Typical owner in 2026 |

|---|---|---|---|

| What changes | Where care starts and how it flows | How work is executed inside the flow | COO/CMO + digital health lead |

| Biggest upside | Access + continuity | Time savings + earlier risk detection | Clinical ops + informatics |

| Biggest risk | Fragmented care, uneven standards | Unsafe automation, bias, “shadow AI” | Compliance + risk + IT security |

| “Killer KPI” | Time-to-visit; resolution rate | Time saved; error/exception rate | Ops analytics team |

| Hardest part | Integration + clinician adoption | Governance + monitoring in production | AI governance committee |

Value chain map (where telemedicine and AI reinforce each other)

| Care stage | Telemedicine contribution | AI contribution | Failure mode to design against |

|---|---|---|---|

| Entry | Digital front door, remote access | Smart routing suggestions | Wrong routing → delays and risk |

| Intake | Structured history & symptoms | Risk flags, triage scoring | Over-triage or missed red flags |

| Consult | Video/chat workflows | Note drafting, chart summary | Hallucinated details in note |

| Diagnostics | Orders, referrals | Imaging prioritization | Silent workflow change in PACS/EHR |

| Follow-up | Async check-ins, RPM programs | Early warning, adherence nudges | Alert fatigue + missed escalation |

| Admin | Billing-ready documentation | Coding/prior-auth assistance | Automation bias, compliance errors |

Market graphs

These three charts remain part of the article (no direct URLs shown), because they summarize the published market endpoints used in the forecast. Telemedicine endpoints are from Fortune Business Insights, and AI-in-healthcare endpoints/CAGR are from MarketsandMarkets/PRNewswire.

- Telemedicine market size chart (2025–2026 and projected 2034).

- AI in healthcare market size chart (2024–2025 and projected 2030).

- Indexed growth comparison (2025=100) with modeled intermediate years derived from those endpoints/CAGR.

Mini-profiles: Top 10 telemedicine websites

Note: “Top websites” here means globally visible, high-traffic brands that repeatedly appear in industry roundups and are widely referenced as recognizable virtual-care entry points (not a claim that each is #1 in every country or the best clinical option for every population).

1) Teladoc Health — integrated virtual care “front door”

Teladoc’s website represents a mature version of telemedicine: not a single service line, but a multi-service virtual care stack that can cover urgent care, primary care, and longer-running programs (such as condition management). Teladoc’s positioning emphasizes full-range virtual care and scale, with marketing that frames virtual care as a long-term system capability rather than an add-on.

Why it matters in 2026: organizations are increasingly shopping for workflow and continuity, not just video. Teladoc’s style of “integrated virtual care” maps to the 2026 reality where the channel is hybrid and remote-first pathways need clean escalation rules and consistent documentation. When a telemedicine website is effectively the “front door,” the hidden work is identity, triage, documentation structure, and handoffs to in-person care.

Best-fit scenarios:

- Employers/health plans seeking broad virtual coverage and a recognizable member experience.

- Health systems that want to extend capacity but standardize protocols.

Operational watch-outs:

- If telemedicine encounters don’t land reliably in the longitudinal record, care fragmentation can increase.

- Scaling multi-service virtual care requires strong clinical governance to keep quality consistent across clinicians and modalities.

2) Amwell — enterprise telehealth + EHR-embedded workflows

Amwell’s website represents enterprise-grade telehealth—built to plug into health systems and payer ecosystems, with a recurring emphasis on platform approach rather than a single clinic. Amwell’s Converge platform is repeatedly described as focusing on integration with existing workflows and EHRs, reflecting the direction large providers want: fewer “extra systems” and more embedded experiences.

Why it matters in 2026: the winners in enterprise telehealth are judged by deployment friction and operational fit. In practical terms, it’s not “Can we do a video visit?” but “Can we route, document, staff, and audit virtual care with the same discipline as in-person?” Amwell’s positioning aligns with that reality, because it frames telehealth as infrastructure for hybrid care.

Best-fit scenarios:

- Health systems wanting EHR-integrated scheduled visits and standardized workflows.

- Payers building a unified digital front door for multiple programs.

Operational watch-outs:

- Integration projects can fail without tight change management (training, workflows, QA).

- “More tools” doesn’t equal “better care” unless pathways are standardized.

3) MDLIVE — broad consumer-style virtual care entry

MDLIVE’s website represents a consumer-accessible entry point to virtual care that typically spans common acute issues plus behavioral health lines in many telehealth models. It appears consistently in “telemedicine companies to know” style roundups, reflecting strong brand visibility and ongoing demand for convenient access.

Why it matters in 2026: high-volume virtual visits create pressure on clinical documentation and safe triage. Organizations increasingly value platforms that can structure intake and route correctly so clinicians spend time on decisions rather than repetitive data gathering. Consumer-facing telemedicine wins when it reduces friction, but it must also defend against fragmentation—especially when users treat the service as “urgent care only” without continuity.

Best-fit scenarios:

- Employers/benefit designs that want accessible urgent care and mental health access.

- Users who prioritize speed and convenience for simple problems.

Operational watch-outs:

- Episodic use without linkage to primary care can reduce continuity.

- Inconsistent escalation rules may increase downstream costs (unnecessary ER or delayed in-person care).

4) Doctor On Demand — broad virtual care brand (urgent + behavioral)

Doctor On Demand’s website represents a well-known virtual care brand commonly mentioned in telemedicine company roundups. It’s positioned around access to clinicians without the barriers of geography, which is exactly the “where problem” telemedicine solves best.

Why it matters in 2026: behavioral health remains one of the strongest telemedicine categories because it is inherently communication-centric and benefits from reduced travel friction. Virtual care programs also increasingly bundle prevention and coaching-style services around clinical visits, which can raise engagement if governance is clear (what is clinical care vs coaching, what is automated vs clinician-reviewed).

Best-fit scenarios:

- Member populations with meaningful behavioral health demand and access gaps.

- Hybrid models where routine follow-ups can be remote-first.

Operational watch-outs:

- Behavioral health at scale requires robust QA, supervision models, and safety escalation.

- Without careful coordination, patients may bounce between platforms and local care.

5) Babylon Health — digital-first care and triage-style experience

Babylon’s website represents a digital-first approach that historically blended telemedicine and triage-like user experiences. It’s regularly included in telemedicine company roundups, which is the main reason it appears in a “top websites” list focused on global visibility.

Why it matters in 2026: even when organizations disagree on the best “AI symptom checker” philosophy, they generally agree on the need for better intake structure and routing. Babylon’s category is an example of where telemedicine and AI narratives blend in public perception—sometimes productively, sometimes creating governance questions (what is advice vs diagnosis, and what is the escalation path?).

Best-fit scenarios:

- Digital-first pathways where intake and navigation are central.

- Users comfortable starting care with structured digital interaction.

Operational watch-outs:

- Governance must clearly define what is automated guidance vs clinician care.

- Regional regulatory differences can shape what features are permitted.

6) HealthTap — access + guidance-style telemedicine entry

HealthTap’s website represents a blend of access and guided navigation—often described as an accessible telemedicine service and frequently included in “telemedicine companies” lists. This category is important because many users start with uncertainty (“Do I need a doctor?”), and guided experiences can reduce friction.

Why it matters in 2026: as telemedicine grows, systems try to reduce avoidable appointments and route correctly. Platforms that structure intake and set expectations can improve throughput and patient satisfaction, but only if they are conservative about safety. In practice, guidance must be paired with strong escalation rules and clear disclaimers.

Best-fit scenarios:

- Users who need fast access and basic navigation for common issues.

- Programs emphasizing convenience and triage efficiency.

Operational watch-outs:

- Over-promising can increase patient risk if escalation is weak.

- Fragmentation remains a concern if continuity is not addressed.

7) Sesame — marketplace-style care access

Sesame appears in broad telemedicine company roundups and represents a marketplace-style access model. Marketplace models can reduce friction by making pricing and availability easier to see, and by enabling faster access for self-pay use cases.

Why it matters in 2026: cost pressure and access gaps keep pushing users toward transparent, fast pathways. Marketplaces can help, but they also raise continuity questions: who owns the longitudinal record, who follows up, and how are outcomes tracked?

Best-fit scenarios:

- Self-pay users prioritizing speed and clear pricing.

- One-off care needs where continuity is less critical (but still desirable).

Operational watch-outs:

- Risk of “transactional care” without follow-up.

- Harder to standardize clinical pathways across many providers.

8) MeMD — consumer urgent care style entry

MeMD appears in telemedicine roundups as a recognizable virtual care provider. This category is often used for straightforward acute issues, where telemedicine’s best ROI is fast access and reduced unnecessary in-person utilization.

Why it matters in 2026: urgent care telemedicine will keep existing, but the growth frontier is hybrid pathways and programmatic chronic care. Acute telemedicine remains important as a front door, but it increasingly needs integration so the visit doesn’t become a “dead-end record”.

Best-fit scenarios:

- Acute, low-complexity issues.

- Overflow capacity when in-person appointments are scarce.

Operational watch-outs:

- Escalation to in-person must be fast when red flags appear.

- Documentation quality must be consistent for downstream continuity.

9) PlushCare — virtual-first primary care orientation

PlushCare appears in telemedicine company roundups and represents a virtual-first primary care approach, which is one of the most important “next chapters” for telemedicine maturity. Primary care telemedicine is less about “one visit” and more about ongoing relationships, prevention, and chronic management.

Why it matters in 2026: health systems are formalizing remote-first pathways for routine follow-ups and chronic management. Virtual-first primary care is attractive because it can reduce wait times and improve access, but it requires stronger protocols than episodic urgent care.

Best-fit scenarios:

- Patients who want continuity and predictable access.

- Programs targeting prevention and chronic disease adherence.

Operational watch-outs:

- Needs strong integration with labs, referrals, and in-person escalation.

- Needs consistent standards so “virtual primary care” doesn’t become superficial.

10) Talkspace — specialty telemedicine (mental health visibility)

Talkspace appears in telemedicine company roundups and is a globally recognized mental health telemedicine brand. Mental health remains one of the most stable telemedicine categories because the modality maps well to conversational care and can reduce stigma and travel barriers.

Why it matters in 2026: mental health demand remains high and staffing constraints are persistent. Tele-mental-health also intersects with measurement-based care and structured follow-up, where digital tooling can improve adherence—if governance and clinical oversight are strong.

Best-fit scenarios:

- Employer mental health benefits, high-demand access programs.

- Users who prefer remote-first mental health support.

Operational watch-outs:

- Must maintain safety escalation pathways and supervision structures.

- Quality variation can emerge without standardized protocols.

Mini-profiles: Top 10 AI-in-medicine websites

This list follows AI Magazine’s “Top 10 AI healthcare companies,” which mixes healthcare-native AI and enabling infrastructure used to build and deploy clinical AI.

1) Google (Health) — AI research and clinical AI direction-setter

Google Health’s website represents a major “direction-setting” layer in medical AI: foundational research, applied AI in diagnostics, and health data approaches that influence the broader ecosystem. The practical significance is less “a single product” and more how a large AI organization shapes patterns that downstream clinical vendors adopt.

Why it matters in 2026: health systems increasingly want AI that is embedded safely into workflows, with monitoring and governance. Large AI organizations influence expectations around model performance and multimodal capability. At the same time, healthcare buyers are becoming more demanding about auditability, risk management, and provenance of outputs—especially for generative AI.

Best-fit scenarios:

- Research-heavy programs exploring imaging AI, multimodal reasoning, and large-scale analytics.

- Partnerships where rigorous validation and governance can be established.

Operational watch-outs:

- Healthcare-grade deployment requires workflow integration, not just high benchmark results.

- Governance must handle bias, drift, and documentation of changes.

2) NVIDIA — compute and platform layer for medical AI

NVIDIA’s healthcare presence represents the infrastructure layer for modern medical AI: accelerated compute, frameworks, and enabling platforms widely used in imaging AI, genomics workflows, and AI development pipelines. The “website value” here is that it is the entry point for tooling that makes clinical AI feasible at scale.

Why it matters in 2026: many organizations will not “buy one AI”. They will assemble a portfolio of models and capabilities, and infrastructure decisions become strategic. Compute and platform choices affect cost, performance, and how quickly teams can iterate, validate, and monitor models.

Best-fit scenarios:

- Imaging groups and research programs building or deploying multiple AI models.

- Enterprises standardizing AI infrastructure for multiple clinical use cases.

Operational watch-outs:

- Infrastructure is not clinical governance—systems still need validation and monitoring.

- Vendor ecosystems can increase complexity without strong architecture discipline.

3) Microsoft — healthcare cloud + workflow AI gravity

Microsoft’s healthcare site represents a convergence of cloud, identity/security, and emerging workflow AI in clinical environments. In 2026, this matters because “workflow AI” often lives where documents, messaging, and productivity tools already exist—so platform choices influence adoption speed.

Why it matters in 2026: clinical teams are overwhelmed by documentation and administrative burden, and generative AI is most attractive where it can draft and summarize safely inside controlled environments. Healthcare organizations increasingly want AI embedded with governance and audit trails, not copied into consumer chat tools.

Best-fit scenarios:

- Enterprises seeking compliant AI enablement integrated with existing IT ecosystems.

- Organizations prioritizing security, identity, and monitoring controls.

Operational watch-outs:

- AI must be constrained to safe scopes; “helpful text” can still be wrong.

- Integration into clinical workflow must be co-designed with clinicians.

4) AWS — enabling layer for healthcare AI and analytics

AWS’s healthcare presence represents a broad enabling ecosystem for healthcare data platforms, AI/ML services, and scalable analytics. The value is less “a single diagnostic model” and more the capacity to build, host, and operate AI systems with reliability, logging, and security controls.

Why it matters in 2026: AI in healthcare increasingly looks like operations, not a demo. That means uptime, monitoring, cost management, and scalable pipelines. Cloud choices shape the feasibility of continuous monitoring and safe iteration.

Best-fit scenarios:

- Healthcare data platforms, AI model hosting, population analytics.

- Organizations building multiple AI applications rather than buying only one.

Operational watch-outs:

- Cloud readiness varies; data quality and governance are still the bottleneck.

- Strong security controls are necessary to prevent PHI leakage and “shadow AI”.

5) Philips — device-embedded AI and monitoring workflows

Philips’ healthcare site represents AI embedded in medical devices, imaging workflows, and patient monitoring—an important category because it tends to be closer to regulated clinical environments and established procurement patterns. AI here often appears as workflow enhancements: automation, reconstruction, prioritization, and decision support around equipment.

Why it matters in 2026: buyers increasingly want AI where clinicians already work—PACS, imaging consoles, monitoring dashboards. Device-embedded AI can reduce adoption friction and make governance easier (since it’s often packaged with enterprise-grade controls).

Best-fit scenarios:

- Hospitals standardizing imaging and monitoring across departments.

- Programs aiming for operational throughput improvements.

Operational watch-outs:

- Avoid “feature sprawl” where many AI tools exist but no pathway changes.

- Post-deployment monitoring remains necessary to detect drift and failures.

6) Siemens Healthineers — imaging AI + diagnostics automation

Siemens Healthineers represents AI tightly linked to imaging and diagnostics. This matters because imaging is one of the most “AI-ready” clinical domains: high-volume signals, standardized outputs, and clear workflow chokepoints.

Why it matters in 2026: imaging departments face throughput pressure, staffing constraints, and rising demand. AI is increasingly used to prioritize worklists, improve reconstruction, and reduce repetitive tasks—often with measurable operational KPIs.

Best-fit scenarios:

- Radiology/diagnostics modernization programs.

- Hospitals seeking consistent imaging workflows.

Operational watch-outs:

- Departments must manage alert fatigue and ensure AI doesn’t silently change triage logic.

- Governance should include audit trails and exception handling.

7) GE HealthCare — AI across imaging and monitoring ecosystems

GE HealthCare represents another major imaging/monitoring ecosystem where AI can be integrated as workflow acceleration and decision support. The point is not “AI as magic,” but AI as a set of incremental improvements that can compound across large installed bases.

Why it matters in 2026: organizations want AI that is deployable at scale with training, QA, and support. Device ecosystem vendors can deliver AI upgrades in ways that match enterprise procurement and operational change.

Best-fit scenarios:

- Health systems with existing imaging/monitoring footprints.

- Programs focused on measurable throughput and quality improvements.

Operational watch-outs:

- “Installed base” does not guarantee adoption; workflow redesign is still needed.

- Monitoring and feedback loops should exist after rollout.

8) Teladoc Health — AI inside virtual care operations

In AI Magazine’s framing, Teladoc also appears as an AI healthcare company, reflecting how telemedicine platforms increasingly incorporate AI into matching, triage support, operational analytics, and safety tooling. In 2026, telemedicine without some level of AI assistance becomes operationally expensive, because the bottleneck shifts from geography to clinician time.

Why it matters in 2026: the most pragmatic AI gains in telemedicine are administrative and workflow-centered—documentation assistance, triage support, and routing—rather than autonomous diagnosis. This aligns with the governance trend: embed AI where scope can be controlled and audited.

Best-fit scenarios:

- High-volume virtual care operations needing efficiency gains.

- Employers/payers wanting scalable navigation and standardized experiences.

Operational watch-outs:

- Over-automation can create unsafe routing if guardrails are weak.

- Governance must prevent unapproved tooling (“shadow AI”) creeping into PHI workflows.

9) Tempus — precision medicine and multimodal data for oncology

Tempus represents a precision-medicine style of medical AI that uses clinical and molecular/genomic data to support oncology decision-making and research workflows. A useful way to think about Tempus is “data structuring + analytics + clinical decision support,” particularly in cancer care contexts. A commonly cited description of Tempus’s approach is combining genomic data with clinical data to generate insights and support treatment decisions.

Why it matters in 2026: precision medicine grows when data becomes more standardized and accessible. AI becomes valuable not only in prediction but also in organizing messy real-world clinical data into structured, usable forms. In oncology, where decisions are complex and evidence changes quickly, tools that synthesize data and match trials can have high perceived value.

Best-fit scenarios:

- Oncology programs seeking data-driven decision support and trial matching.

- Research-heavy institutions leveraging multimodal datasets.

Operational watch-outs:

- Clinical decision support must be validated and integrated responsibly.

- Data governance and patient consent/usage policies must be clear.

10) Arterys — imaging-focused clinical AI identity

Arterys is positioned as a clinical AI company focused on interpreting medical images with more consistency and efficiency (as framed in AI Magazine’s list). Imaging AI remains a major adoption lane because it can be measured and integrated into existing radiology workflows, where time-to-read and prioritization are operational chokepoints.

Why it matters in 2026: imaging departments need throughput and reliability, and AI can help with prioritization and quantification. The 2026 success pattern is not “AI that replaces clinicians,” but AI that reduces repetitive tasks and improves triage—while clinicians remain accountable.

Best-fit scenarios:

- Radiology workflow optimization and prioritization.

- Programs that can track measurable outcomes (turnaround time, error rates).

Operational watch-outs:

- Require clear audit trails and exception handling.

- Post-deployment monitoring is needed to catch drift and workflow side effects.

AI PCs for medical imaging diagnostics telehealth 2025–2026 ( recommendations for healthcare & medical imaging)

For Medical Imaging & High-End Diagnostics:

- Workstations with NVIDIA RTX AI: Systems equipped with NVIDIA RTX 6000 Ada Generation or GeForce RTX 40-series GPUs are essential for real-time rendering, CT/MRI reconstruction, and running AI models like Zebra Medical Vision or Aidoc.

- Specialized Hardware: Look for Onyx Healthcare Medical AI PCs or HP Z-series workstations that support NVIDIA IGX Orin for edge AI processing in operating rooms.

For Telehealth & Administrative Diagnostics:

-

- Microsoft Copilot+ PCs: Devices featuring NPUs (Neural Processing Units) from the Intel Core Ultra (Series 2), AMD Ryzen AI 300, or Qualcomm Snapdragon X Elite series are best for telehealth. They enable local, low-latency AI features (like live captions and eye contact correction) and secure on-device data processing compliant with HIPAA.

- Top Models (2026): The ASUS Zenbook S 14, Surface Laptop 7, and Lenovo ThinkPad T14s Gen 6 are highly rated for battery life and portability in clinical settings.

Comparative tables

Telemedicine platform types (what to choose in 2026)

| Telemedicine type | Best for | Not ideal for | Key features to require | KPI to track |

|---|---|---|---|---|

| DTC urgent care | Low-acuity acute issues, fast access | Longitudinal chronic care | Strong triage, fast escalation | Resolution rate; re-contact rate |

| Virtual-first primary care | Continuity, prevention, chronic management | One-off convenience only | Labs/referrals integration, care plans | Follow-up adherence; care gaps closed |

| Enterprise telehealth | Health systems expanding capacity | “Plug-and-play” expectations | EHR embed, QA governance | Time-to-visit; clinician utilization |

| Specialty telemedicine | Mental health, derm, women’s health | Broad generalist scope | Specialty protocols + QA | Outcome measures per specialty |

| Marketplace | Self-pay transparency, choice | Tight continuity and standardization | Credentialing, clear SLAs | Satisfaction; repeat use; safety escalations |

Recommendations by buyer

- Clinics/health systems: prioritize enterprise telehealth + virtual-first primary care, because integration and standardized pathways create durable value in hybrid care.

- Insurers/employers: prioritize broad-access DTC + specialty (mental health), but require coordination mechanisms to reduce fragmentation.

- Startups: avoid “me-too video visits”; differentiate via workflow, specialty protocols, or integration primitives.

AI tool types in medicine (how to buy safely)

| AI type | Best for | Highest risk | “Safe default” guardrail | KPI to track |

|---|---|---|---|---|

| Documentation/ambient | Notes, summaries, inbox drafts | Hallucinations, PHI leakage | Draft-only + human sign-off | Time saved; correction rate |

| Imaging triage/quant | Worklist prioritization, measurement | Silent workflow shifts | Audit logs + monitoring | Turnaround time; miss rate |

| Predictive risk models | Deterioration/readmission | Bias, drift | Subgroup testing + monitoring | Calibration; false-negative rate |

| Operational AI | Staffing, capacity planning | Bad incentives | Human oversight | Wait time; capacity utilization |

| Patient-facing bots | Navigation, reminders | Unsafe advice | Narrow scope + escalation | Escalation correctness; complaint rate |

Recommendations by buyer

- Clinics: start with documentation AI + imaging triage where governance is easiest and ROI is measurable.

- Insurers: focus on operational AI and navigation (member routing) with careful safety escalation.

- Startups: win by proving workflow outcomes and offering auditability, not by claiming autonomy.